Table Of Content

The new home insurance companies may also help offset the loss of major insurers like Farmers Insurance and Progressive, which both announced last month that they’re not renewing home policies in Florida. In one case cited by State Rep. Bob Rommel, the homeowner received $35,000; the attorney got $756,000. John Hendrick, of Madeira Beach, said a December 2022 law requiring Citizens policyholders to also carry flood insurance beginning in April 2023 would force him to drop his Citizens policy in June. One reduces the amount of time insurers have to pay claims from 90 days to 60 days, she said. Another requires insurers to provide reasons for underpayment or denial of claims. Attorneys have argued that the reforms hurt policyholders by forcing them to hand over portions of their claim settlements to pay legal bills.

Best insurer for cheap rates: Stillwater

Independent agents can collect insurance insurance quotes from many insurers for you. And, if you qualify, they can also get home insurance quotes from Citizens. As building costs and property values have skyrocketed, Citizens reportedly dropped 2,267 policies with replacement value of over $700,000 over the past year.

Full list of the best homeowners insurance in Florida

If you need a mortgage loan, however, most lenders require you to take out homeowners insurance to protect the property for the length of the loan. One reason may be that Miami has a higher risk of hurricane damage than Jacksonville. Miami-Dade County also has more than double the population of Duval County. Another reason may be that the Jacksonville Fire and Rescue Department has 64 fire stations serving 918 square miles, while Miami-Dade Fire Rescue has 68 stations serving more than 2,000 square miles. Here you can see how your premiums shift based on varying deductibles for $300,000 in dwelling coverage.

Home Insurance 2024: Possibly Pay Up To 35% More in Florida, California and 2 Other States - Yahoo Finance

Home Insurance 2024: Possibly Pay Up To 35% More in Florida, California and 2 Other States.

Posted: Sat, 30 Mar 2024 07:00:00 GMT [source]

Average cost of homeowners insurance in 2024

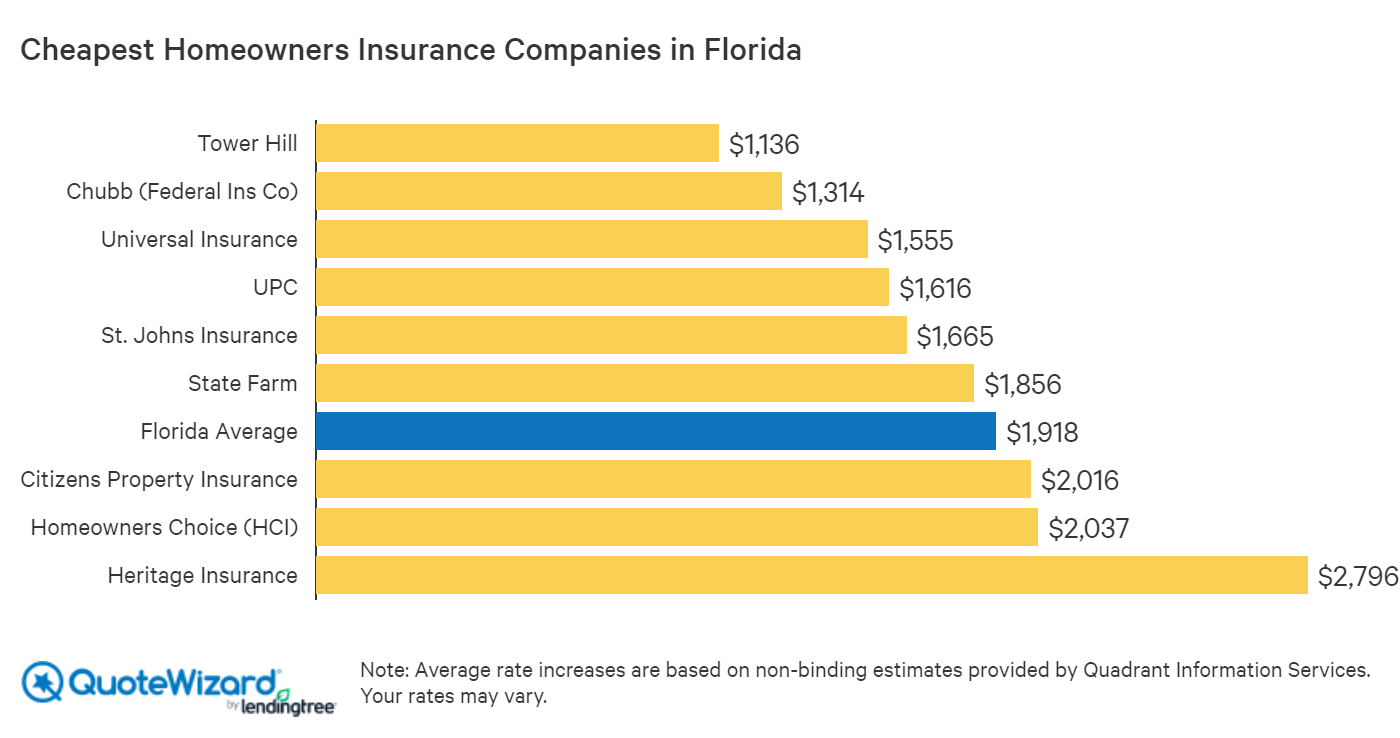

This can facilitate seasonal residents who are worried about damage to their properties while they’re out of state. Homes in Florida are at risk of hurricane damage, something a basic homeowners insurance policy typically doesn’t cover. You’ll need to add more coverage to protect your home from these disasters. Tower Hill and State Farm offer the most affordable home insurance in Florida.

Insurance tips for Florida homeowners

Your escrow balance is the amount in your escrow account that the mortgage lender uses to pay expenses like property taxes. If you’re looking for mobile home insurance, learn why you need it, where to get it, and what it covers. For nearly a decade, Nick has created content for mom-and-pop businesses and global corporations.

See reviews of Progressive home insurance

Before deciding if working with a Public Adjuster is the right choice for you, it is important to know your legal rights as a policyholder and the Public Adjuster’s responsibilities. This consumer guide details the information required in a valid contract, explains how Public Adjusters handle claims and the fees a Public Adjuster is permitted to charge you. By being informed about the process prior to signing a contract, you can serve as your best advocate.

Ranking as the second-best home insurance in Florida, Allstate has several unique coverage options not found among other providers, including Home Rental Coverage. Allstate also offers yard and garden coverage, which increases the limits for trees, landscaping and riding lawn mowers. Please note that these rates may not include any coverage for hurricane damage. Florida faces a property insurance crisis, with rates rising fast, which makes finding affordable Florida homeowners insurance from a solid company harder, especially if you live near the coast. In 2022, Florida’s legislature passed three bills designed to discourage lawsuits and stabilize the insurance market, with the hope of reducing prices for homeowners in the long term.

The cost of homeowners insurance in Florida is skyrocketing for several reasons. First, the state sees a lot of expensive natural disasters, such as hurricanes. As America’s largest insurer, State Farm stands out for its long list of coverage options. Its policies generally include extra dwelling coverage in case it costs more than expected to rebuild your home after a covered disaster. You may also be able to add coverage for things like utility lines, damage from backed-up drains and the breakdown of major appliances. You can lower your homeowners insurance in Florida by taking advantage of discounts offered through your home insurance company.

Homeowners to face huge premium jump as insurers seek 50% premium hike - Insurance Business

Homeowners to face huge premium jump as insurers seek 50% premium hike.

Posted: Mon, 12 Feb 2024 08:00:00 GMT [source]

More homes on the greens: 132 townhomes planned for this Broward golf course

Erie has very low complaint levels about its home insurance, and much better than the industry average. State Farm has been consistently near the industry average for home insurance complaints, though higher than top competitors. Westfield has consistently had a low complaint ratio to state departments of insurance compared to the industry average over the past three years. Yes, to some degree – and that’s a good thing considering 6,500 Floridians file sinkhole-related insurance claims each year.

DiscountsRatings are based on the number of discounts a company offers in comparison to other insurers. We include rates from every locale in the country where coverage is offered and data is available. When comparing rates for different coverage amounts and backgrounds, we change only one variable at a time, so you can easily see how each factor affects pricing. The homeowners also have a $1,000 deductible, a $500 hail deductible and a 2 percent hurricane deductible (or the next closest deductible amounts that are available) where separate deductibles apply.

If your home was damaged, you should try to prevent more damage, such as boarding up a broken window. We wouldn’t suggest fixing the problem before contacting your insurance company. Once the insurance company is done with its investigation, the insurer will offer a claims payout. So if you have $300,000 in dwelling coverage and a 2% hurricane deductible, you’d be responsible for $6,000 toward a hurricane-wind loss.

To check your flood risk, put your address into the Federal Emergency Management Agency's flood maps or visit RiskFactor.com, a website from the nonprofit First Street Foundation. Hurricanes and other tropical storms typically cause two types of damage — wind and water — and a standard homeowners insurance policy may not fully cover them. Although NerdWallet doesn’t have access to average homeowners insurance rates from Citizens, we include it here because many Florida homeowners find themselves with nowhere else to turn for coverage. Keep in mind, though, that dwelling coverage isn’t the only coverage type on a home insurance policy. Increasing or decreasing either coverage type — or any of the other types of home insurance coverage on your policy — will affect your premium.

USAA’s high customer service rating is thanks to its coverage and discount offers. Included in its policies at no additional cost is the Contents Replacement Cost coverage, which can pay for the loss of personal belongings at its most recent replacement cost and no depreciation. USAA also offers Home Rental coverage, which protects a policyholder and their property if they choose to rent out rooms or the entire unit. In terms of discounts, policyholders can reduce their premiums by simply being claims-free, bundling and having security devices at home.

Looking at average home insurance costs for the 20 largest cities in Florida, we found that Palm Bay has the cheapest homeowners insurance in the state, followed by St. Pete and Gainesville. Plus, while many competitors don't have the financial strength to pay out claims after several natural disasters in the same year, State Farm isn't one of them. Best for financial strength and stability — only six insurance companies out of nearly 70 we reviewed hold this title.

This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. AI-powered legal analytics, workflow tools and premium legal & business news. Legislators have assigned $27.6 million for grants, which should go fast. Like the home program, the condo program also matches $2 in state money for every $1 owners spend.

Flood insurance must typically be purchased separately if you’d like to insure your home against flood events. That provision has created an environment that encourages the filing of lawsuits for inflated claims. That, said Friedlander, has led more than a dozen insurers to stop writing new policies in Florida. Six Florida residential insurers were declared insolvent in 2022 due to excessive litigation and 24 other companies are on the state’s watch list because of concerns over their financial stability.

No comments:

Post a Comment